Travel Smart

Travelling should be fun, not worrisome!

Lost Luggage? Delayed Flights? Accidents?

Travel worries that lead to unexpected expenses and stress!

Keep the stress and worries at bay while you travel with Travel Smart.

Travel Smart is a comprehensive travel insurance that will let you enjoy your trip. Ease your travel worries with an insurance that is designed for a safe and responsible travel even in the time of pandemic.

Travel Smart gives you the power to protect yourself, your family, and your community.

Travel Safe. Travel Responsibly. Travel Smart.

*Travel Smart is exclusive to passengers departing from or travelling within the Philippines.

Ready for Travel Smart?

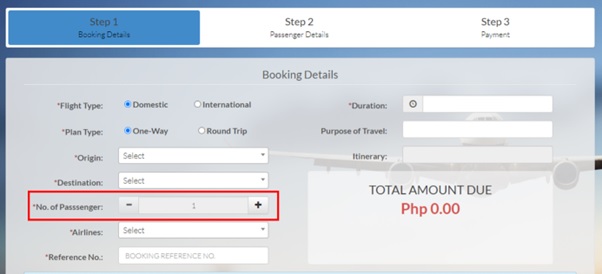

Apply for Travel Smart

Fill out the online application form.

Make sure that all your details are correct.

Pay for your insurance plan

You may pay your premium through online banking, over-the-counter deposit via our partner banks, bills payment in convenience stores, or in selected remittance outlets.

Get a copy of your Proof of Cover

- Travel Smart shall send you a Proof of cover after payment verification.

- Download and print your Proof of Cover. Do not forget to pack this along with your travel essentials!

Enjoy your worry-free trip!

Affordable Plans

| DOMESTIC | Amount Due |

|---|---|

| ONE WAY | Php 227.94 |

| 1 - 4 Days | Php 282.96 |

| 5 - 9 Days | Php 451.30 |

| 10 - 14 Days | Php 597.12 |

| 15 - 19 Days | Php 690.71 |

| 20 - 29 Days | Php 869.50 |

| 30 - 45 Days | Php 1,055.68 |

| 46 - 60 Days | Php 1,331.77 |

| 61 - 90 Days | Php 1,736.72 |

| 91 - 120 Days | Php 2,237.94 |

| 121 - 150 Days | Php 2,841.56 |

| 151 - 180 Days | Php 3,393.60 |

| ASIA | Amount Due |

|---|---|

| ONE WAY | $7.64 |

| 1 - 4 Days | $8.91 |

| 5 - 9 Days | $14.76 |

| 10 - 14 Days | $19.35 |

| 15 - 19 Days | $21.90 |

| 20 - 29 Days | $28.26 |

| 30 - 45 Days | $34.12 |

| 46 - 60 Days | $43.29 |

| 61 - 90 Days | $56.16 |

| 91 - 120 Days | $72.58 |

| 121 - 150 Days | $92.95 |

| 151 - 180 Days | $110.78 |

| WORLDWIDE | Amount Due |

|---|---|

| ONE WAY | $14.51 |

| 1 - 4 Days | $17.83 |

| 5 - 9 Days | $28.65 |

| 10 - 14 Days | $38.71 |

| 15 - 19 Days | $44.57 |

| 20 - 29 Days | $57.04 |

| 30 - 45 Days | $71.05 |

| 46 - 60 Days | $90.54 |

| 61 - 90 Days | $119.95 |

| 91 - 120 Days | $153.57 |

| 121 - 150 Days | $198.28 |

| 151 - 180 Days | $237.88 |

All plans are with covid-19 cover.

Travel Smart will charge and accept payments in Philippine Peso (Php).

Premiums stated in US Dollars (USD) will be converted using the conversion rate at the time of application.

An additional Payment Gateway fee amounting to Php 20.00 will be charged for all payment transactions.

Schedule of Benefits

| PERIL/S | DOMESTIC | ASIA | WORLDWIDE/SCHENGEN |

|---|---|---|---|

| Personal Accident | ₱ 500,000 | $20,000 | $50,000 |

| Accidental Burial Benefit | ₱ 50,000 | $2,000 | $5,000 |

| PERIL/S | DOMESTIC | ASIA | WORLDWIDE/SCHENGEN |

|---|---|---|---|

| Medical Necessary Expenses (cashless) | ₱ 500,000 | $20,000 | $50,000 |

| -dental expense sublimit | ₱ 50,000 | $2,000 | $5,000 |

| Emergency Medical Evacuation | ₱ 50,000 | $2,000 | $5,000 |

| Repatriation of Remains | ₱ 50,000 | $2,000 | $5,000 |

| Emergency Communication Expense | ₱ 2,500 | $200 | $400 |

| Hospital Confinement Daily Cash Benefit (up to 10 days) | ₱ 1,000/day max. of ₱ 10,000 | $100/day max. of $1,000 | $200/day max. of $2,000 |

| Compassionate Visit | travel cost + up to ₱ 1,000/day maximum of ₱ 30,000 | travel cost + up to $100/day maximum of $3,000 | travel cost + up to $150/day maximum of $5,000 |

| Return of Minor Children | travel cost + up to ₱ 1,000/day maximum of ₱ 30,000 | travel cost + up to $100/day maximum of $3,000 | travel cost + up to $150/day maximum of $5,000 |

| PERIL/S | DOMESTIC | ASIA | WORLDWIDE/SCHENGEN |

|---|---|---|---|

| Trip Cancellation | ₱ 25,000 | $2,000 | $4,000 |

| Trip Curtailment | ₱ 25,000 | $2,000 | $4,000 |

| Flight Delay (for each 12-hour delay) | up to ₱ 1,000 max of ₱ 10,000 | up to $50 max of $500 | up to $100 max of $1,000 |

| Aircraft Hijack | ₱ 1,000/day max ₱ 10,000 | $50/day max of $500 | $100/day max of $1,000 |

| Missed Connecting Flight (for each 12-hour delay) | N/A | up to $50 max of $500 | up to $100 max of $1,000 |

| Flight Diversion (for each 12-hour delay) | N/A | up to $50 max of $500 | up to $100 max of $1,000 |

| Loss / Damage of Baggage and Personal Effects | max. of ₱ 25,000 | max. of $2,000 | max. of $2,500 |

| -Any One /Set / Pair of Articles (sublimit) | ₱ 3,500 | $200 | $250 |

| -Loss of Firearm (sublimit) | ₱ 3,500 | $200 | $250 |

| -Loss of Sports Equipment (sublimit) | ₱ 3,500 | $200 | $250 |

| Loss of Personal Money on Overseas | N/A | $500 | $1,000 |

| Loss of Travel Documents | ₱ 10,000 | $1,000 | $2,500 |

| Emergency Cash - Due to loss of travel documents | N/A | $150/day max of 500 | $350/day max of 1,400 |

| Baggage Delay Benefit (for each 12-hour delay) | up to ₱ 2,500 max. of ₱ 25,000 | up to $200 max. of $2,000 | up to $250 max. of $2,500 |

| PERIL/S | DOMESTIC | ASIA | WORLDWIDE/SCHENGEN |

|---|---|---|---|

| Personal Liability including Legal Expenses | ₱ 500,000 | $20,000 | $50,000 |

| Rental Vehicle Protection | N/A | $2,000 | $7,500 |

| Others - Frequent Flyer Members Only | N/A | $100 | $200 |

| Extension of Period of Trip | included | included | included |

| PERIL/S | DOMESTIC | ASIA | WORLDWIDE/SCHENGEN |

|---|---|---|---|

| Medical Hospitalization Expenses due to Covid-19 | ₱ 500,000 | $20,000 | $50,000 |

| Repatriation of Remains due to Covid-19 | ₱ 50,000 | $2,000 | $5,000 |

| Hospital Confinement due to Covid-19 (up to 10 days) | ₱ 1,000/day max. of ₱ 10,000 | $100/day max. of $1,000 | $200/day max. of $2,000 |

| Quarantine Allowance due to Covid-19 (up to 10 days) | ₱ 1,000/day max. of ₱ 10,000 | $100/day max. of $1,000 | $200/day max. of $2,000 |

| Trip Cancellation due to Covid-19 | ₱ 25,000 | $2,000 | $4,000 |

| Trip Curtailment due to Covid-19 | ₱ 25,000 | $2,000 | $4,000 |

| 24-Hour Worldwide Travel Assistance | included | included | included |

| DOMESTIC | ASIA | WORLDWIDE/SCHENGEN | |

|---|---|---|---|

| Medical Necessary Expenses | ₱ 500 | $10 | $10 |

| Trip Cancellation | ₱ 500 | $10 | $10 |

| Trip Curtailment | ₱ 500 | $10 | $10 |

| Loss / Damage of Baggage and Personal Effects | ₱ 500 | $10 | $10 |

| Hospital Confinement / Quarantine Benefit due to COVID-19 | 3 days | 3 days | 3 days |

Terms and Conditions

Travel Smart Policy Wordings (Schengen Compliant)

Stress-free Benefits Claim

Alliedbankers Insurance Corporation commit to provide you a convenient and seamless processing of your insurance needs.

For quick processing of your benefit claims, follow these simple steps:

Step 1 - Ensure you have the required documents:

- Copy of Policy or Proof of Cover

- Duly accomplished Claim Form/s (Download Here)

- Complete Flight Itinerary and/or Boarding Passes

- Any other documents in support of the claim (See Complete List)

Step 2 - Send an e-mail with the required documents attached to abictravel@emaglobal.com.ph

Step 3 - Kindly wait for our Claims Department to contact you within 7 working days after submission of documents.

Frequently Asked Questions (FAQs)

How can I purchase Travel Smart insurance?

You may purchase Travel Smart Insurance directly at ABIC's website link:

https://www.alliedbankers.com.ph/travelsmart

How much does Travel Smart insurance cost?

Get a quick quote for Travel Smart Insurance through

https://www.alliedbankers.com.ph/travelsmart

Who can purchase Travel Smart insurance?

Travel Smart is exclusive to passengers departing from or travelling within the Philippines who are at least two (2) weeks old but not more than 80 years old on the Effective Date of coverage.

Can I purchase Travel Smart insurance if I am not a resident of the Philippines?

Yes, as long as you are departing from the Philippines.

Can I avail of Travel Smart insurance if I am travelling from another country to the Philippines?

No, because Travel Smart is for outbound flights only that will depart from the Philippines.

Is Travel Smart insurance limited to specific airlines?

We allow any commercial airline, with an established route, as long as it is departing from the Philippines. Non-scheduled aircraft i.e., Cessna planes, and helicopters are not covered.

What is your maximum no. of days for travel?

We can accommodate a Single Trip for up to 180 days.

You may visit our website www.alliedbankers.com.ph/travelsmart to get a quick quote and refer to our Schedule of Benefits to learn more about the benefits and limits, and a brief description of what is covered by each benefit.

Do I need to undergo a Covid-19 test before departure?

Not required but some countries require travelers to undergo a Covid-19 test (RT-PCR Test, Antigen Test, etc.) test before departure, or as required by the law / governing body/agencies before departing their trip from the Philippines.

Disclaimer: Due to the evolving situation of Covid-19 (mandatory) protocols, all insured are encouraged to confirm the travel requirements directly with the offices or websites of your place of destination.

Can I avail of Travel Smart insurance within the day of the flight?

It will depend on the time of your flight. Since the policy time starts at 12:01 am, we suggest enrolling your travel insurance two (2) days before your scheduled flight to avoid technical difficulties when obtaining your Proof of Cover.

What if I have a roundtrip ticket but will have a connecting flight to multiple countries, what should I indicate on my destination?

Kindly input the last country where you will depart from.

If your travel will cover Domestic, Asia, and Worldwide, the highest package will prevail and should be the one indicated in the enrollment.

What if I have multiple airline reference nos. due to my connecting flight, what should I encode?

You can input both reference nos. as it has no restrictions for the no. of characters.

If I'm traveling as a group with my family or friends under one booking reference no., will I apply individually or as a group?

You can apply it as one application, just indicate the no. of passengers on Step 1.

Kindly take note that the maximum no. of passengers is up to 10 pax.

Does the Travel Insurance with Covid-19 Rider required in the airport?

Learn about the restrictions and protocols observed in your travel destination. Here are some guides to help you plan your trips:

Domestic Travel: http://bit.ly/2LaorMK

International Travel: http://bit.ly/3asvRUf

All insured are encouraged to confirm the travel requirements directly with the offices or websites of your place of destination.

Can business travelers purchase this travel insurance?

Yes, but there are excluded occupations as follows:

- Flight crew (except as a passenger) - a separate product would apply.

- Seagoing vessel crew (except as a passenger)

- Train crew (except as a passneger)

- Mine workers

- Oil rig workers

- Aeriel photographers

- Workers handling explosives

- Personnel of navy, military, air force, law enforcement or civil defense service or operation.

When does Travel Smart insurance coverage take effect?

For Trip Cancellation, the benefit takes effect upon acceptance and approval of the application and receipt of premium payment and shall terminate upon commencement of the Trip.

For all other benefits, insurance is effective three (3) hours before the Air Carrier's scheduled flight departure time, and ceases on whichever of the following occurs first:

- Three (3) hours after the Air Carrier's flight arrival time on the return flight for a round-trip itinerary or for one-way itineraries, upon Insured's arrival at the Air Carrier's flight destination;

- Upon the expiry of the Period of Insurance stated in the Policy Schedule; or

- Upon the death of the Insured except for death-related benefits.

What are the excluded countries?

- Afghanistan

- Iran

- Iraq

- Syria

- Belarus

- Cuba

- Democratic Republic of Congo

- North Korea

- Lebanon

- Liberia

- Russia

- Somalia

- Sudan

- South Sudan

- Ukraine

- Zimbabwe

And any other countries subject to Sanctions by United States of America or European Union.

I'm getting a Schengen Visa, are you accredited?

Yes, you may refer to this link https://www.eeas.europa.eu/philippines/travel-study_en for verification.

Kindly select the Worldwide package when applying for a Schengen Visa.

Does Trip Cancellation cover flight cancellation due to border closures and country restrictions?

It is NOT covered. Any government prohibition, regulation, or intervention is not covered under the policy.

Trip cancellation only covers loss of deposits/advance payment for travel or accommodation which have not been or will not be used but become forfeited subject to the terms and conditions of the group policy wordings.

Does Travel Smart insurance a cashless transaction?

Travel Smart is a cashless transaction for medical emergency related/hospitalization claims but should be coordinated with our emergency response team - EMA global.

For emergency assistance or pertaining to medical cases concerns, please contact:

24/7 Worldwide Medical Assistance - EMA Global Assistance Philippines, Inc.

Landline: (+632) 8396 - 9884

Whatsapp No.: +1 (252) 518 - 4888

Email: abictravel@emaglobal.com.ph

Other benefits i.e. damaged luggage, baggage delay, etc. are reimbursable, subject to the review and acceptance of our Claims Team.

All claims are subject to the review and acceptance of our Claims Team.

What are the benefits offered?

Please refer to our Schedule of Benefits to learn about the Travel Smart insurance benefits and limits and a brief description of what is covered by each benefit.

Also, please read the Group Policy Wordings (Domestic / International) carefully for the complete details of the terms, conditions and exclusions of the insurance cover.

What are the benefits offered if with Covid-19 Rider?

Please refer to the table below for your easy reference:

After my payment, when will I receive my Proof of Cover (POC)?

Once payment is confirmed thru Payment Channels, you will receive an Email and SMS Notification.

If you did not receive your POC in your inbox, please check your “SPAM” folder.

What should I do if I do not receive a Travel Smart insurance Confirmation of Cover?

You can directly send us a message to our FB Page “Alliedbankers Insurance Corporation” or please contact:

Travel Smart Insurance Customer Service

Email: travelsmart@alliedbankers.com.ph

Call us from Monday to Friday, 8:30 am to 5:30 pm

Trunkline: (+632) 8245-2886 local 100

Mobile: 0917-850-6446

My flight was rebooked/canceled by my assigned airline, how can I make changes to my Travel Smart insurance?

If your trip has not yet commenced, you need to contact our Travel Smart Insurance Customer Service at the soonest possible time through the following contact nos.: (+632) 8245-2886 local 100 / 0917-850-6446 or email us at travelsmart@alliedbankers.com.ph for the corresponding changes on your Travel Smart insurance, subject for approval.

Kindly take note that you need to present your rebooked/revised ticket upon request for changes.

I have noticed that the personal details on the Confirmation of Cover are incorrect, what should I do?

Please contact Travel Smart Insurance Customer Service at +632 8245-2886 local 100 for the corresponding changes to your Travel Smart insurance.

Travel Smart insurance Customer Service

Email: travelsmart@alliedbankers.com.ph

Call us from Monday to Friday, 8:30am to 5:30pm

Trunkline: (+632) 8245-2886 local 100

Mobile: 0917-850-6446

I would like to cancel the trip, is Travel Smart insurance premium refundable?

It will be on a case-to-case basis only and as long as the travel has not commenced yet. Subject to a charges of necessary taxes and approval of our underwriters.

Please contact our Travel Smart Insurance Customer Service through the following contact nos.:

(+632) 8245-2886 local 100 / 0917-850-6446 or email us at travelsmart@alliedbankers.com.ph for the corresponding changes on your Travel Insurance, subject to approval.

What should I do if my tourist visa was denied but I already availed my travel insurance?

If your travel coverage has not commenced yet, you need to contact our Travel Smart Insurance Customer Service at the soonest possible time through the following contact nos.: (+632) 8245-2886 local 100 / 0917-850-6446 or email us at travelsmart@alliedbankers.com.ph.

Can I get a refund if my visa is denied but the policy already started?

No.

Can I get a refund if my visa is denied but the policy has not yet started?

Yes. You need to contact our Travel Smart Insurance Customer Service at the soonest possible time through the following contact nos.: (+632) 8245-2886 local 100 / 0917-850-6446 or email us at travelsmart@alliedbankers.com.ph for the refund request, subject to approval.

What if I got hospitalized before my return trip and I can't advice for an extension, what else can I do?

In the event that your unable to return home due to unforeseen circumstances listed below, ABIC will extend your policy period for FREE. Kindly contact us or your family members and relay your new return flight details. Please note that any excess period is subject to additional premium.

- 7 days extension for the public transport delay

- 30 days extension if due to bodily injury or sickness of the Insured

How do I make a claim?

Please refer to our guide Stress-free Benefits Claim for more information.

What should I do if I need emergency or travel assistance?

For Emergency Cases, please contact:

24/7 Worldwide Medical Assistance - EMA Global Assistance Philippines, Inc.

Landline: (+632) 8396 - 9884

Whatsapp No.: +1 (252) 518 - 4888

Email: abictravel@emaglobal.com.ph

For Non-Emergency Assistance, you may contact our Customer Service from Monday to Friday (8:30am to 5:30pm) at (+632) 8245-2886 local 100 or 702 or e-mail travelsmart@alliedbankers.com.ph

When must I inform Travel Smart insurance of the claim?

- Medical Expenses or Assistance Claims

- All Other Claims

If you have been hospitalized, or require emergency evacuation or repatriation following an accident or sickness, you must contact our Travel Smart Assistance team immediately or as soon as reasonably possible so that necessary arrangements can be made.

For Emergency Cases, please contact:

24/7 Worldwide Medical Assistance - EMA Global Assistance Philippines, Inc.

Landline: (+632) 8396 - 9884

Whatsapp No.: +1 (252) 518 - 4888

Email: abictravel@emaglobal.com.ph

For Non-Emergency Assistance, you may contact our Customer Service from Monday to Friday (8:30am to 5:30pm) at (+632) 8245-2886 local 100 or 702 or e-mail travelsmart@alliedbankers.com.ph

As soon as reasonably possible (and no later than 30 days after the date of incident giving rise to the claim), you should complete the Claim Form and submit a Claim Notification to Alliedbankers Insurance Corporation.

What documents are required to process a claim?

- Copy of Policy

- Claims Form, duly accomplished (Download Here)

- Complete Flight Itinerary and/or Boarding Passes

- Copy of Passport (pages with biographic data and entry/exit immigration stamp dates)

- Detailed Incident Letter

- Any other documents in support of the claim (See Complete List)

What would be the most important points/reminders for COVID-19 Rider claim to be valid?

- The client must be diagnosed by the doctor/physician as Covid-19 positive during the trip overseas.

- The client must provide a Negative Pre-Departure Covid-19 test such as PCR obtained w/in 72 hours or as required by the law / governing body/agencies before departing his/her trip from the Philippines.

Our flight was scheduled to depart at 7:00 pm but it was delayed due to inclement weather and moved to 9:00 pm, is it claimable?

FLIGHT DELAY BENEFIT

If during the Period of Insurance, while the Insured is on a trip, the departure of the Air Carrier's flight in which the Insured had arranged to travel is delayed for at least twelve (12) consecutive hours at any single location overseas from the time specified in the travel itinerary supplied to the Insured due to:

- inclement weather

- Strike or other job action by the employees of the Air Carrier on which the Insured is scheduled to travel

- equipment failure of the aircraft on which the Insured is scheduled to travel.

Is swab kit or RT PCR can be reimbursed?

If you take the RT PCR test before your departure, it's not reimbursable nor claimable to your Covid-19 Rider Medical Expenses coverage.

Can I file a claim for Trip Cancelation due to Covid-19?

Yes, but it will have a deductible based on your specific coverage i.e Domestic, Asia, or Worldwide.

How long does it take to process the claim?

We always strive to process claims as quickly as possible. To avoid delay and to ensure your claims is handled efficiently, please complete the Claim Form in full and submit all required proof of loss documentation.

Please click on the link if you want to know more about How to Make a Claim.

How are claims paid?

Claims will be paid directly to the medical service provider or via check to the Insured depending on the type of claim. All claims are settled depending on the claim issue and currency.