The year 2021 began with too much hope of an early “recovery” from the COVID-19 pandemic. This optimism was anchored on the Government’s projections that the vaccines will start arriving by December 2020 and herd immunity from an aggressive vaccination program would have been achieved by March 2021. Unfortunately, this was too optimistic and exactly the opposite happened. Instead, fear continued to grip the nation and the surge from the Delta and Omicron variants followed. Relief came only towards the end of 2021, early in December.

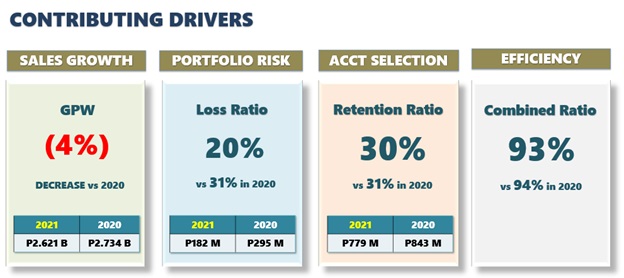

Consequently, business continued to stagnate. While the Gross Production plateaued and the income dipped, the story behind that evolved was different.

Sources of Business

In 2020, when the Covid-19 pandemic broke out, ABIC’s retail business suffered significantly as the country went into its most strict lockdown measures. Not only were retail clients prevented from leaving their homes, ABIC’s frontliners, from the branch heads to the individual agents, were likewise prevented from meeting existing and potential clients. Thus, the steep decline in retail business. Corporate clients, on the other hand, thrived despite the closure of retail business. Our Corporate Sales Force continued to meet with corporate accounts and brokers via online platforms like Zoom. Thus, enabling Alliedbankers to make up for the retail sales drop.

In 2021, the retail business slightly recovered but, unfortunately, with more than a year of lockdowns, corporate business started to suffer, as well. So, while the retail business held, corporate business went down.

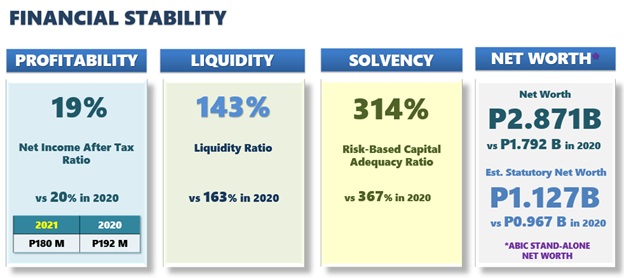

Despite the setback, Alliedbankers, after the acquisition of PNB General Insurers, Inc., was able to manage a respectable consolidated income of P180 million from the previous year’s combined income amounting to P192 million.

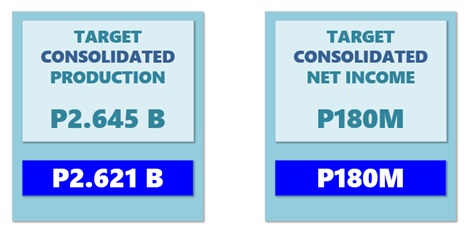

For the year ended December 31, 2021, Alliedbankers recorded a consolidated gross production and consolidated net profit of PhP 2.645 billion and PhP 180 million, respectively, achieving the target consolidated net profit and garnering 99.10% consolidated gross production completion. While Gross Production plateaued, consolidated net profit was lower in 2021 despite reducing the loss ratio by 1/3 due to the decline in retention ratio by 1%. In addition, the significant increase in general and administrative expenses, especially on the salaries and professional fees, as a result of the acquisition of PNB General Insurers Co. negatively impacted the bottom line, as well.

ABIC remained financially strong in 2021 despite the lower net earnings, with profitability at 19%, liquidity at 143% and Solvency at 314%. ABIC’s net worth in 2021 has increased by 60% and is now at PhP 2.871 billion. In addition, ABIC’s 2021 estimated statutory net worth of PhP 1.127 billion, which excludes non-admitted assets and liabilities, also exceeded the 2021 Insurance Commission’s minimum statutory net worth of PhP 900 million. Based on ABIC’s 2022 forecast, it is on track to meet the 2022 minimum statutory net worth of PhP 1.30 billion by the end of 2022.

To Preserve and Strengthen

With normalcy a far possibility due to the present economic headwinds, the management team quickly changed course and instead of the growth targets, switched to preserving the existing business and strengthen Alliedbankers’ ability to compete and grow the business when the country is back to normal. While the pandemic has taken its toll on all of us, Alliedbankers laid the foundations for a solid and sustainable recovery.

Key to preserving the existing base are the initiatives that were started and completed in the years 2020 and 2021.

First is the completion of the Business Requirement Document (“BRD”) in April 2021 which will serve as the blueprint for ABIC’s operational control and efficiency. Second is the acquisition of PNB General Insurers, Inc. (“PNB Gen”) by Alliedbankers resulting in the acquisition of its nationwide branch network and additional manpower who have had a long history of technical expertise in the industry. Third is the acquisition of the industry’s leading IT system, GENiiSYS, which will now pave the road to full automation and further enhance ABIC’s budding digital business.

With these in place, Alliedbankers stands ready to unleash its potential that now goes beyond its core business which is the LT Group of Companies.

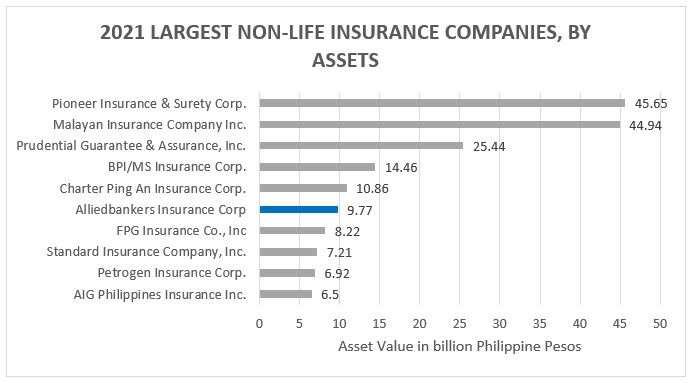

Source: https://www.statista.com/statistics/858855/philippines-leading-non-life-insurers-by-assets/

Note: ABIC’s consolidated total assets is not yet officially published in the 2021 data of Statisa.

In 2021, Alliedbankers was among the top 10 largest non-life insurance companies in the Philippines in terms of assets with a total consolidated asset value of PhP 9.77 billion.

While Alliedbankers has always ranked high in terms of Net Income and Statutory Net Worth, it was never among the top ten players in the industry except when its 2020 Net Income ranked 9th in the industry. With the key initiatives in 2020 and 2021, Alliedbankers will now be among the top ten non-life insurance companies in terms of Assets, Gross Production, Statutory Net Worth, and Net Income, among others.

Business Requirement Document

Through the collaboration of the Project Pearl Team, ABIC Subject Matter Experts, Process Owners, and SGV’s Risk Advisory Service Team, ABIC’s comprehensive Business Requirement Document (BRD) was completed in April 2021. Business and technical solutions were provided in the BRD for all business areas to simplify and automate critical processes, establish roles and responsibilities, and strengthen internal controls to be able to ensure business efficiencies, maximize growth opportunities, improve data analytics capabilities, and continuously deliver Excellent Delivery Service.

Further, as part of the continuous process improvement initiatives, ABIC has also implemented the following:

Digitalization. Technology has played critical role in our ability to adapt in these unprecedented times. The pandemic, which acted as a major catalyst for digital transformation in the past 2 years, led us to redefine the future of work at ABIC and forge ahead with our digital strategy.

ABIC continued to embrace work from home arrangement in 2021 to ensure everyone’s safety. Laptops, Desktops, and Pocket WIFI were provided since the beginning of the pandemic, enabling the company to continue work productivity despite of the community quarantine. By operating the business online and streamlining the process, ABIC was able to achieve paperless business operations in the past 2 years.

As business transactions becoming increasingly digital, ABIC utilized online banking facilities for collection and disbursement transactions. ABIC also adapted digital marketing, penetrating various social media platforms to increase brand awareness and market its products to retail and corporate markets.

New Organizational Structure. ABIC established a new organizational structure and acquired seasoned officers from PNB Gen as Department Heads to effectively manage critical business segments. Departments filled with new head includes (1) Fire and non-fire department under the Underwriting Division and (2) Bancassurance, LTG, BGA, and microinsurance under the Sales and Marketing Division.

Focus Groups for Regulatory Compliance. ABIC formed various focus groups which spearhead the planning, process implementation, monitoring, and compliance of the Company with various industry regulations and standards such as Data Privacy, Sustainability Reporting, IFRS 17, among others. ABIC also sponsored certifications and workshops for these focus groups to maintain the teams’ competence and commitment to these projects.

Acquisition of PNB General Insurers Inc.

ABIC realized its expansion plan by acquiring full ownership of PNB Gen Co. in 2021. The consolidation brought together the geographic reach of PNB Gen and the product offerings and expertise of ABIC.

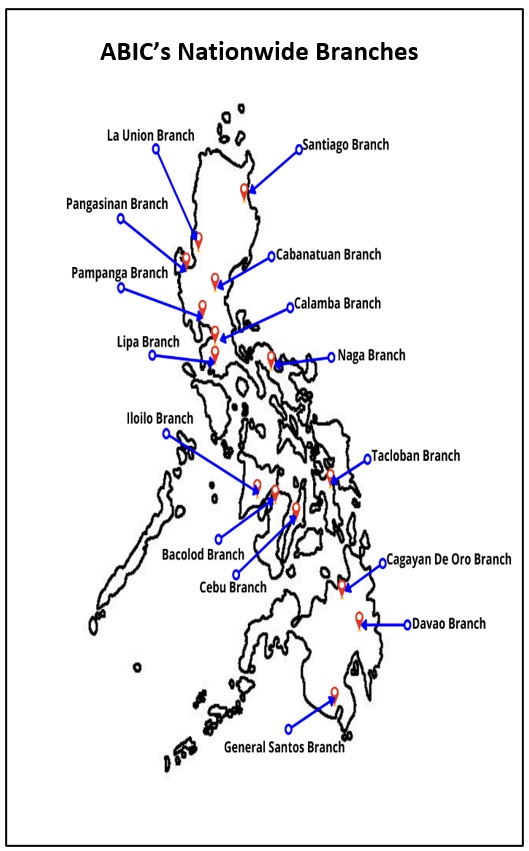

Branch Network. With the successful acquisition of PNB Gen in 2021, ABIC now owns 15 branches in various strategic locations throughout the Philippines, which is a key component in realizing ABIC’s goal of establishing a Nationwide Distribution Network to expand its retail footprint and allow the Company to enter untapped markets where competition is weak, loss ratios are low, and profit margins are higher.

Talents. On top of the 15-branch network, ABIC was equipped with a new pool of talents and experts in Technical Sales, Underwriting, Claims Processing and Evaluation, Information Technology, Accounting, and Treasury. The company’s workforce went from 128 employees in August 2021, to 250 employees upon integration of PNB Gen’s business in September 2021. The acquisition of technical talents from PNB Gen during the latter part of 2021 will allow ABIC in the coming years to increase its market share in the Brokers, General Agents, Agents (BGAAs) business, capture opportunities in the retail and corporate open market and optimize coverage of the Captive Market with Philippine National Bank and the Lucio Tan Group of Companies.

IT System. Following the acquisition of PNB Gen, ABIC accelerated its digitalization and automation by transitioning to GENiiSYS, a comprehensive and integrated system for insurance business. This newly acquired IT system upgrades ABIC’s IT infrastructure, simplifies various processes, and enhances its data analytics capabilities.

As the acquisition strengthens our position in the insurance market, sustainable growth is foreseeable for the future.

Digital Technology Enhancement Through Integration of GENiiSYS

In October 2021, ABIC began its integration of GENiiSYS, a comprehensive, fully integrated, and flexible system for General Insurance that extensively covers all the necessary functions from sales and marketing, underwriting, reinsurance, claims, and accounting, all the way up to General Ledger and financial reporting. The ERP integration, which was led by the Core Conversion team, provides ABIC the following advantages:

- It serves as a centralized computer information system to effectively manage and integrate the operations of ABIC’s branches nationwide.

- It enhances ABIC’s data analytics capabilities as it provides a data warehouse and allows inquiry of data in various degrees of detail from transactional to summarized.

- It strengthens ABIC’s information and cyber security defenses through firewall upgrades and implementation of Virtual Private Network (VPN).

- It complies with the requirement of regulatory bodies such as the Insurance Commission, Bureau of Internal Revenue and Security Exchange Commission. Further, changes in standards such as IFRS 17, Insurance Contract, have also been incorporated into the system.

With the completion of the Business Requirement Document in 2021, GENiiSYS is set to undergo extensive system enhancement to enable full automation and strengthen ABIC’s digital business. As ABIC continues to enhance the capabilities of the new system, the company is also looking forward to launching a mobile-based portal for product distribution and channel management and other areas of business, upscaling its commercial operations to a whole new level.

![]()